My new working paper-July. 18th

In this paper I estimate the causal effects of demand shocks on the growth of small firms. I use data from several new sources and, as identification strategy, exploit a governmental procurement process that allocates public contracts through a randomized contest. I find that demand shocks have a positive and significant impact on short-term measures of growth and no impact on long-term measures. On average, an increase in demand of 10% will increase wage expense by 2% and current assets by 5% during the year of the shock. Firms that won during consecutive years show an increase in their levels of fixed assets. Available here

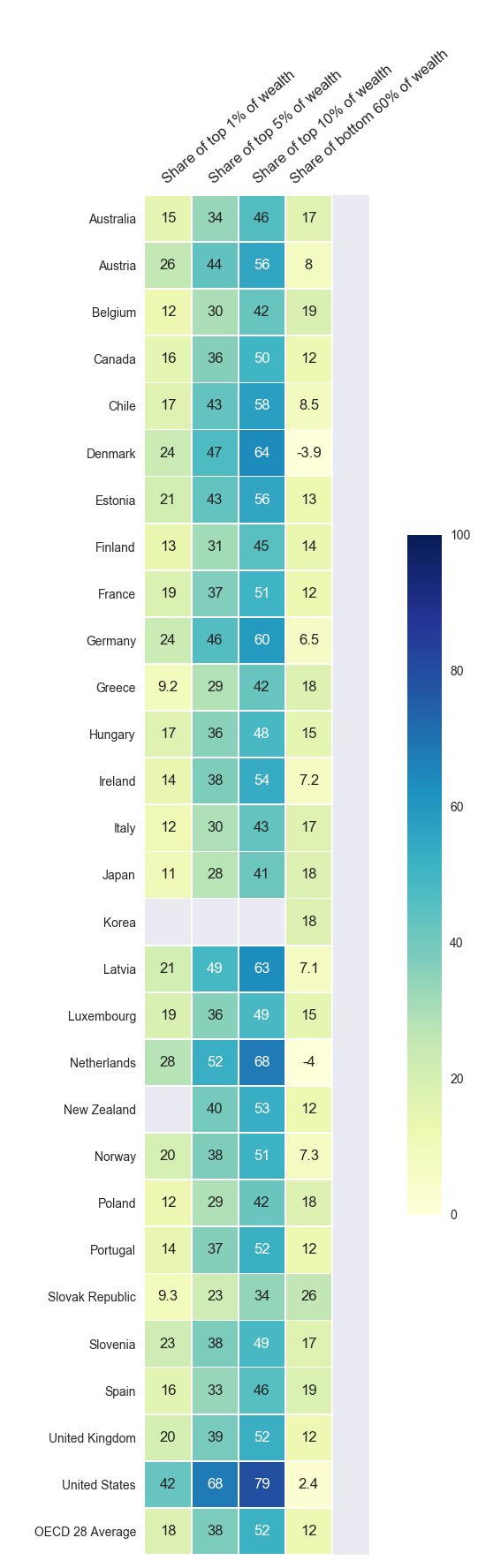

Facts about wealth distribution accross OECD countries- Oct 1st

- The average household wealth in 2010 PPP terms is $258,600

- The richest OECD countries across are the US, UK and Luxemburg

- The poorest OECD countries are Latvia, Chile, and Hungary

- Overall, most household wealth is non-financial and is derived from home ownership

- The richest 1% of households owe, on average, 52% of total wealth

- In the US, the richest 1% of households owe, approximately,79% of total wealth

- Full article and code here

Figure 1-Wealth ownership of the richest and poorest households across OECD countries

Links

30-06-2017- Is it ethical to automate your job and not tell?

- A new study on the economic impact of climate change, from SCIENCE

- From Tyler Cowen’s e-mail

Dear Professor Cowen,

In places with weak institutions or corruption, might we want some workers to be so bad at their jobs that we can rest assured they are at least honest? Here’s my anecdote… In New York I’m frustrated that uber drivers follow google maps so literally. They go crosstown on major boulevards like 23rd Street or 34th Street like Google Maps tells them to, when everyone knows a sidestreet would be quicker. When my driver’s app was glitching out, it took me ten minutes to persuade him that we were going in the wrong direction because he trusted his phone to the death. In NYC I long for old school cabbies who had the whole grid memorized and knew all the tricks.

But yesterday, I had to take an uber from a remote nontourist area of Sao Paulo to the airport, and I was thrilled that my uber driver was as clueless as I was. I don’t speak a word of Portuguese and I was bewildered by the city’s topography, and one hears about kidnappings and coerced tipping from unsavory drivers occasionally. But because this guy was hopeless without google maps, all I had to do to know I could trust him was to glance at his dashboard-mounted tablet and observe whether he was following the directions. That way, I knew very transparently that we were going to the airport not to his secret lair across town. If he was skilled enough to navigate without aid, his trustworthiness would have been, to my detriment, opaque.

Can this remotely be generalized? In situations where public trust is in question, it’s optimal for some workers to be bad at their jobs if it means that they have to observably rely on external guidance? For example, maybe it’s reassuring that in an airline cockpit, the first officer is relatively inexperienced, because our imagination of the captain’s additional “mentorship” role increases our confidence that things will be done by the book, like in a classroom, as opposed to expediently, like in a normal workplace? As with my prior emails to you, I hope either that this has been interesting, or that stealing a minute of your attention is not as costly as I fear!

Sincerely,

Matt Grossman

A quick JS scrap tutorial

04-04-2017In the following tutorial, I scrap data of the Brazilian Anti-corruption program. I show you how to use your browser and JavaScript to quickly obtain dates from a website. [Read more]

Two minutes of advice from economist to Trump

02-02-2017

Ph.D. Comics

Links

20-09-2017-

Wells Fargo fired 5,300 employees, their CEO won't resign and the reason why Prosecuting Wells Fargo Executives Won’t Solve Anything:

It’s plain why this happened. The cause was a familiar two-step among the management of the massive corporations that dominate global banking and many other industries. Step one: Set aggressive sales and earnings targets, using employee compensation as the incentive to get there. Step two: Fail to monitor the salespeople (or traders, or engineers, or whomever might be on the front lines several levels down) who inevitably respond to the enormous financial and career pressures—and lax supervision—by crossing ethical and legal lines.

Many people think this sort of thing keeps on happening because we haven’t prosecuted enough people or sentenced those who have been convicted to enough prison time. This belief is erroneous. In the early 2000s, dozens of executives of major corporations, including Enron and WorldCom, were imprisoned, some for more than 20 years. (I was a prosecutor in the Enron cases.)

Those prosecutions apparently did nothing to deter the risk-taking orgy of the banks and their investment markets during the mortgage-backed securities craze, even though the institutions that crashed our financial system employed practices that were simply less illegal versions of what the rogue companies of 2001 and 2002 had done. The “less illegal” part explains why criminal cases against bank executives proved so difficult to mount after 2008: The Enron-era prosecutions, as much as a deterrent, might have highlighted the sort of behavior that lands an executive in prison and given the next generation of corporate managers a clearer idea of how to skirt, and exploit, the lines of the law.

How to create maps with Stata

03-09-2016Stata allows you to create a wide gamut of maps. I write this guide with two main goals in mind: to supplement the resources found online and to highlight functionalities that I find helpful. Stata is not the best software to create maps. Nonetheless knowing how to do so is a convenient way to avoid having to use multiple programss. We are going to use the package SPMAP created by Mauro Pisati and shp2dta by by Kevin Crow. [Read more]

Analyzing traffic tickets using Ipython

05-05-2016I recently switched to Ipython for my data analysis and exploratory work. Although, I prefer Stata or R for any serious data analysis, Ipython has an incredible competitive advantage when it comes to sharing, publishing, and visualizing results. First, you can see the results below your code which makes it a very convenient way to learn about your data. from how programmers have dealt with version control, or GIT as it is known in that field. [Read more]

Weekly links-December 30th

-

Permanent home for researcher's data. Looks very promising.

-

Map of the world's pollution Guess which cities is the most poullted?

-

Ecuador debates plan to ammend the consitution. Here is an interesting article on the economist Average lifespan of a Latin American constitution? 16.5 years

How to use GIT

I am willing to make a $5 bet that somewhere in your presentations or papers, you have file names along the lines of myfile_final_edited_Milenko.doc, myfile_final_final.doc , or myfile_final_usethisone_oct_mf_final.xls. From experience, I can attest to the confusion that this type of taxonomy creates. As economists and analysts I think we can learn from how programmers have dealt with version control, or GIT as it is known in that field. [Read more]

Weekly links-November 16th

"...I told him that we would only purchase the cocaine if we could agree to a price that would allow [us] to make enough profit from the cocaine to make it worth taking on the risk of the extra kilos.

-

Do Criminals have rational expectations? Apparently yes! From the Grand Jury testimony of a former drug smuggler.

The quote is from page 9. Article and testimony.

Weekly links-November 9th

-

Deaton and Banerjee debating RCT's. here

-

Should children pay back to their parents? From Freakonomics

-

Sach's on China

The case against Excel

Though at first it might seem odd that, as an economist, I have decided to devote my first blog post to Excel, I must admit that I have been surprised to see the number of professionals that use Excel for serious data analysis. Thus, I consider it my “duty” to advise you against its perils and save you countless hours and possible embarrassments. But don’t get me wrong! As a recovering Excel-holic, I am a witness to Excel’s seductiveness. Its simplicity and instant gratification make the software a bridge between the nerds and the pragmatic. Nonetheless, if you are using Excel as your main data analysis tool, you must be warned that it is that very parsimoniousness which has the potential to make your work worthless. [Read more]

Looking for Data?

Want to get your hands on some data? Even before I started my PHD, I knew that I wanted to focus on empirical work. While I have a deep respect for theorists, my comparative advantage and, more importantly, my interests lie in testing new theories and evaluating public policies. Getting started was very difficult! I knew the topic that I wanted to research (actually I knew what I did not want to research), I had a neophyte’s econometric skills, and knew the software well. However, if your intention is to go beyond an insipid descriptive analysis and to produce publishable academic work, I realized that you also need a great idea. Although there truly is no replacement for the scientific method approach, one thing that helped and inspired me was to see other people’s work and what data is out there. Navigating the waters might expand your vision to things that you did not think possible. Who knew that you could use fishing patterns to predict illegal fishing? Or that there is a link between a country’s index of corruption and the propensity of its diplomats to pay for traffic tickets in New York. [Read more]